Is The US Debt a Threat to Democracy?

(note: This article was originally composed 4 years ago. Click on the links within the article for latest figures)

The Industrial Revolution (1820-1870) ushered in significant advances in agriculture which resulted in an increased supply of food and raw materials. Developments in technology resulted in increased production, efficiency, profits, commerce, both foreign and domestic. Industries directly affected were textiles, coal mining, iron, transportation, and steam. The United States was second only to England in the production of wealth and export of goods. The American economy was strong and the dollar was gaining global recognition and nations were waiting in line for America’s exports and the American currency.

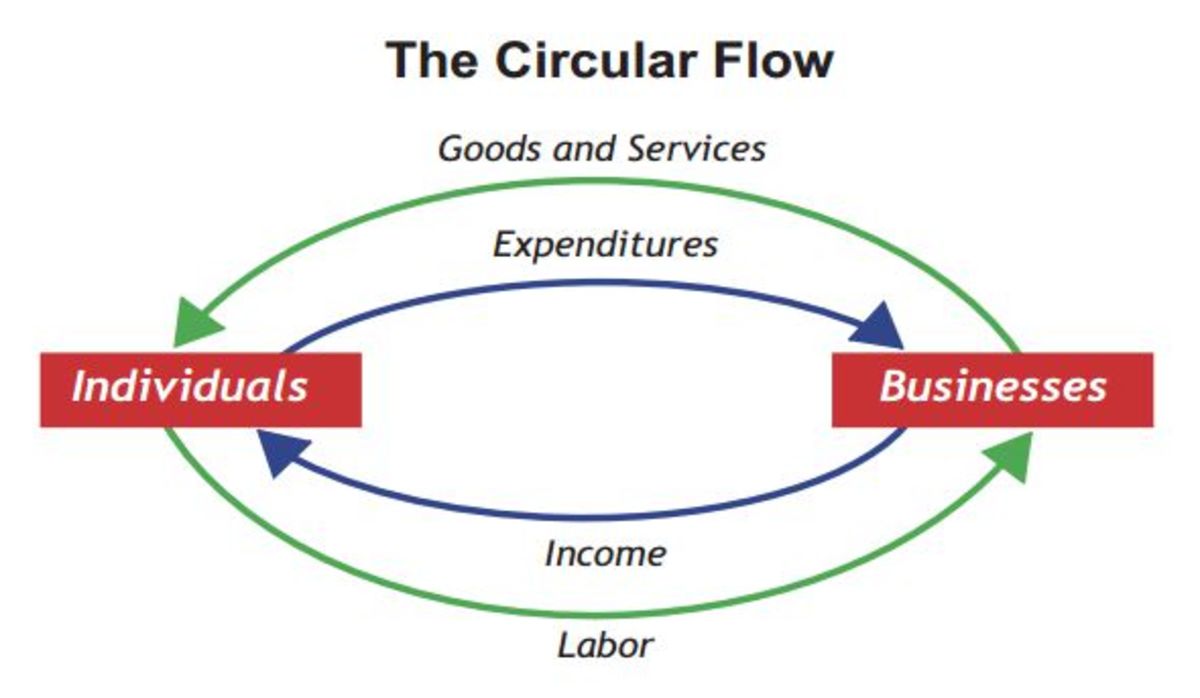

But this rapid growth began to decline around the turn of the century and America was on the path to becoming a debtor, instead of a creditor nation. The culprit - globalization, an area the United States wasn’t psychologically prepared for. Fast forward a few years and we now see the United States in economic peril, on the brink of economic disaster and owing more to rogue nations, putting limitations on America’s ability to spread and maintain Democracy around the world.

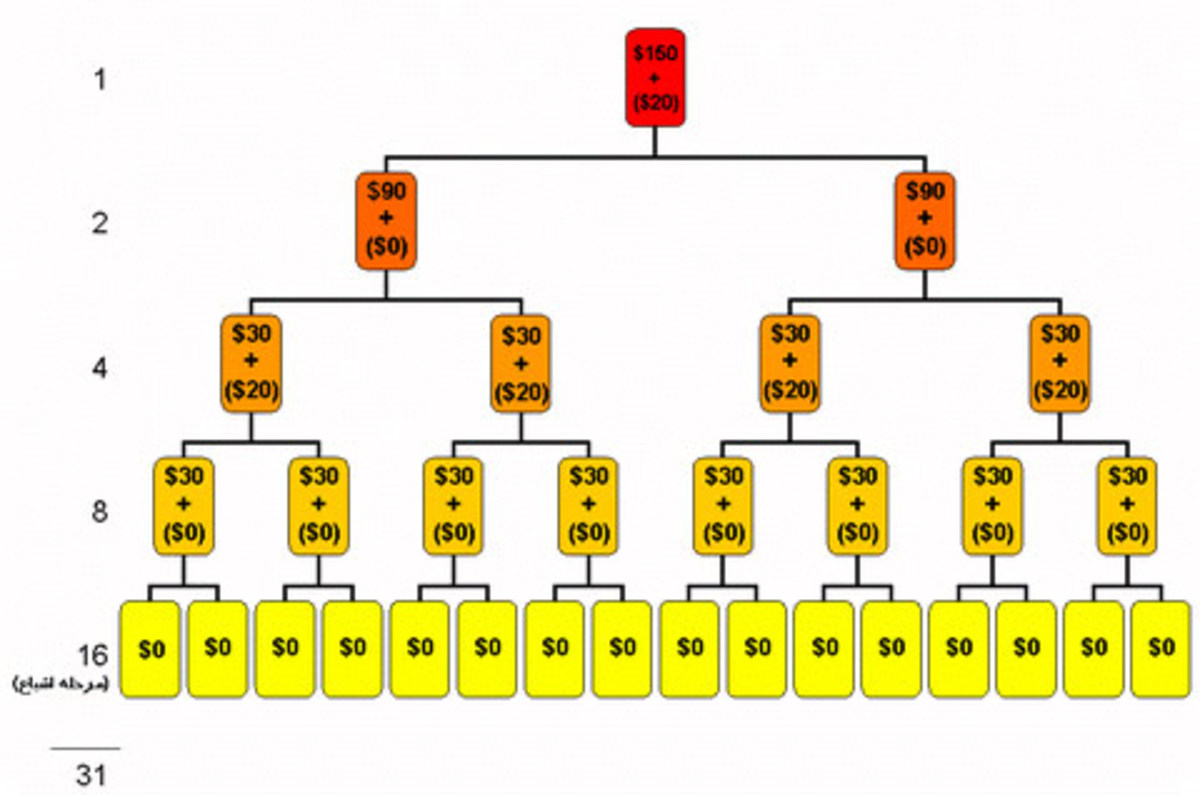

The U.S. national debt now stands at more than $8.3 trillion. $2 trillion is owned by foreign nations, doubling since 2000. As of March 2016 China held over $1244.6 billion worth of U.S. Treasuries, significantly above the $60 billion it held at the end of 2000. Japan now owns $1137.1 billion worth of U.S. Treasuries. America has borrowed untold billions from oil exporter nations from 2000 - 2008, many who despise America such as Venezuela, Ecuador, Iran, Libya, Algeria, Indonesia, and Iraq. According to the US Treasury Department several nations, primarily Middle Eastern nations, now own $263.4 billion worth of U.S. debt.

Saudi Arabia, China, and Russia are buying US debt at alarming speeds and none of which are democracies, or true friends of America. The United States economy is increasingly dependent on a group of creditors who do not have its best interests at heart and they are gaining bigger and bigger stakes in the American economy. This puts the value of the American dollar in the hands of foreign nations which makes the US more and more vulnerable to coercion and blackmail. This ownership also decreases American influence over the world’s largest market, the $24 trillion in foreign exchange that changes hands daily. The dollar’s value can be influenced by decisions made by foreign governments regarding the selling of dollar assets. What’s also at stake is leverage on matters as diverse as U.S. home mortgage rates and America’s global political clout.

Former Japanese Prime Minister Ryutaro Hashimoto simply wondered aloud regarding the fate of the US economy if Japan diversified and began to sell some of its $1137.1 billion in U.S. Treasury securities. The Dow Jones Industrial Average plunged by the largest single day amount immediately following this comment. Since then, other foreign nations have wondered aloud about dumping U.S. treasuries, also causing ripple effects through global markets. Another significant risk in foreign ownership of US Debt is the possibility of foreign nations choosing to stop accumulating the debt and start spending it. If this happens, the U.S. currency in circulation would drive the value of the dollar down, making American holdings less expensive relative to assets in other currencies such as the Euro. As a result, American corporations and businesses could increasingly become targets of foreign acquisitions. Recently, we’ve seen in the news where American Corporations are already being purchased by foreign companies at alarming rates.

The US debt is so great that the threat of other nations inducing a U.S. economic disaster by just refusing to lend more money is now a painful reality. As this debt grows, and it most likely will, America will be less able to protect strategic industries from foreign takeovers, putting a once independent way of life and a stable democracy in jeopardy. The $700 billion bailout package at the beginning of the Obama Administration a good start but it was more borrowed money and unless the industries receiving the money can make a different on the world economy, then America is simply $700 billion plus interests in additional debt. America has non democratic enemies, more so in the past sixteen years between the Bush and Obama Administrations alone, and those non democratic enemies now control US debt and subsequently the US economy.

The national/global debt is turning what was once a productive, economically sound nation of producers into a poor nation of consumers. Will the next generation of Americans become the new biblical Israelites - searching for a new promise land of milk and honey? If so, who will be the next Moses? Will it be Donald Trump, Hillary Clinton, or the struggling Bernie Sanders - and what will be the event, or events to trigger the exodus towards economic freedom? Will it be continued back-door obsolete trade agreements - or a major market crash due to foreign debt owners selling Americas' bad bonds - or massive foreign takeovers of American corporations due to declining American influence as a result of massive global debts?

In the words of the infamous Harold Melvin and the Blue Notes I offer this suggestion.... "Wake Up Everybody, No More Sleeping in Bed" No More Backwards Thinking - Time For Thinking Ahead".